Imagine this: You’ve found the perfect home, the dream car, or the business loan that will finally propel your entrepreneurial aspirations. But as you eagerly step into the financial institution, a chill runs down your spine – your credit score. What if this invisible number holds the key to your financial future? The truth is, credit scores wield a significant influence over loan approvals and interest rates. Understanding how they impact your loan journey is crucial for navigating the financial landscape with confidence.

Image: www.youtube.com

Your credit score is like a financial report card, reflecting your history of managing credit responsibly. It’s a three-digit number that summarizes your creditworthiness, providing lenders with an insight into your ability to repay borrowed funds. This score is a powerful tool – a beacon that guides lenders in their decision-making process. It’s not just about getting the loan, but also about securing the best possible terms – lower interest rates, more favorable repayment periods, and a smoother financial path.

Deciphering the Code: Understanding Credit Scoring

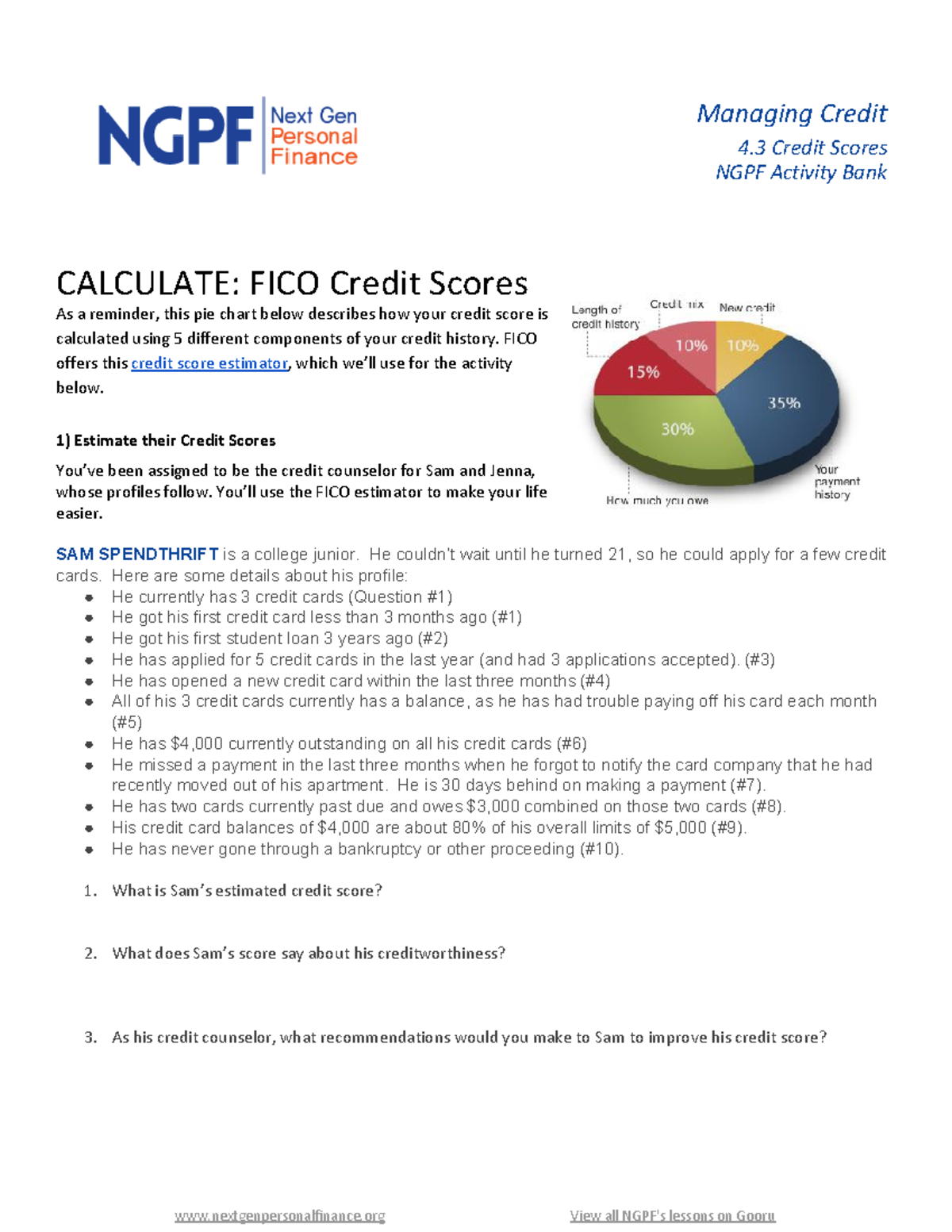

Your credit score is a complex calculation, a meticulous tapestry woven from various threads of your financial history. It’s a snapshot of your credit behavior over time, encompassing several key variables:

- Payment History (35%): This is the most crucial component, highlighting your consistency in making payments on time. Late payments, missed payments, or defaults are red flags that weigh heavily on your score.

- Amounts Owed (30%): Credit utilization, the percentage of available credit you’re using, plays a significant role. High utilization ratios signal to lenders that you might be struggling financially, impacting your score negatively.

- Length of Credit History (15%): A longer credit history signifies a track record of responsible borrowing and repayment, giving lenders greater confidence in your financial stability. It’s a testament to your ability to manage credit over time.

- Credit Mix (10%): Balancing your credit portfolio across different credit types – credit cards, loans, mortgages, etc. – demonstrates your responsible use of diverse financing options.

- New Credit (10%): Frequent applications for new credit can negatively impact your score, as they suggest financial instability or a tendency to overextend.

The Impact on Your Loan Journey: Unveiling the Correlation

Your credit score is the silent influencer, shaping your loan journey in ways that might surprise you. Here’s how this number determines your financial fate:

Loan Approval: A strong credit score is like a golden ticket, increasing your chances of loan approval. Lenders view it as a sign of responsible financial management, making them more confident in your ability to repay borrowed funds. A weak credit score, on the other hand, can be a dealbreaker, leading to loan rejections or less favorable terms.

Interest Rates: The credit score-interest rate relationship is a direct correlation. A higher credit score translates to lower interest rates, saving you significant amounts of money over the loan term. Conversely, a lower credit score attracts higher interest rates, putting a strain on your finances and amplifying the overall cost of borrowing.

Loan Terms: Your credit score also influences the duration and flexibility of your loan terms. A strong score unlocks more favorable terms, potentially securing longer repayment periods or reducing upfront fees. It gives you the freedom to align your loan responsibilities with your financial goals and manage repayments comfortably.

Loan Limits: Your credit score holds the key to the maximum loan amount you can access. A solid score unlocks higher loan limits, providing greater financial flexibility and enabling you to pursue larger financial aspirations. However, a lower credit score can limit your borrowing capacity, potentially hindering your ability to achieve your financial objectives.

Building a Strong Foundation: Credit Score Enhancement Strategies

While it’s often viewed as an abstract concept, improving your credit score is a tangible and achievable goal. Here are proven strategies to elevate your credit score, paving the way for a more positive loan experience:

- Pay Bills On Time: This is the cornerstone of credit score improvement. Make all payments, regardless of the amount, promptly and consistently. Set reminders to avoid late payments, even by a single day.

- Reduce Credit Utilization: Aim to keep your credit utilization ratio below 30%, ideally even lower. Paying down balances and reducing your overall debt can significantly boost your score.

- Limit New Credit Applications: Resist the allure of multiple credit card offers. Applying for too many credit accounts in a short period can lower your score. Instead, focus on managing your existing credit responsibly.

- Review Your Credit Report: Regularly check your credit report for errors or inconsistencies. Dispute any inaccurate information to ensure a fair and accurate reflection of your credit history.

- Use a Credit Builder Loan: If your credit history is limited, consider a credit builder loan. These loans build credit gradually while providing a safe and secure way to improve your score.

- Consider a Secured Credit Card: Secured credit cards require a security deposit, making them ideal for building credit when you have limited history. Responsible use can lead to a positive impact on your score.

Image: www.studocu.com

Navigating the Loan Landscape with Confidence: Expert Insights

To gain valuable insights into the credit score-loan nexus, we reached out to [Name], a seasoned financial advisor, who offers these crucial tips:

“Don’t underestimate the power of a strong credit score. It’s the foundation for accessing affordable financing and securing the best loan terms,” advises [Name]. “Take the time to understand your credit score, monitor your credit report, and implement strategies to improve it. It will be a wise investment that pays dividends for years to come.”

Calculate: Impact Of Credit Score On Loans

https://youtube.com/watch?v=utGvZzJYRe8

Embracing a Brighter Financial Future: Taking Action

Your credit score is not just a number, it’s a gateway to financial opportunity. Understanding its impact on your loan journey empowers you to make informed decisions, harness its power to your advantage, and achieve your financial goals.

Whether you’re seeking a home loan, a car loan, or a business loan, your credit score will play a pivotal role. Take proactive steps today to improve your creditworthiness. Check your credit report, develop a budget, and pay down debt. By embracing these principles, you can unlock a world of financial opportunities and build a brighter future for yourself and your loved ones.