Navigating the world of finances can feel overwhelming at times, especially when it comes to obtaining important documents like bank statements. You might need a bank statement for various reasons: applying for a loan, submitting it to a landlord for rent verification, or simply tracking your own financial history. However, figuring out the process of requesting one can be confusing, particularly if you haven’t done it before.

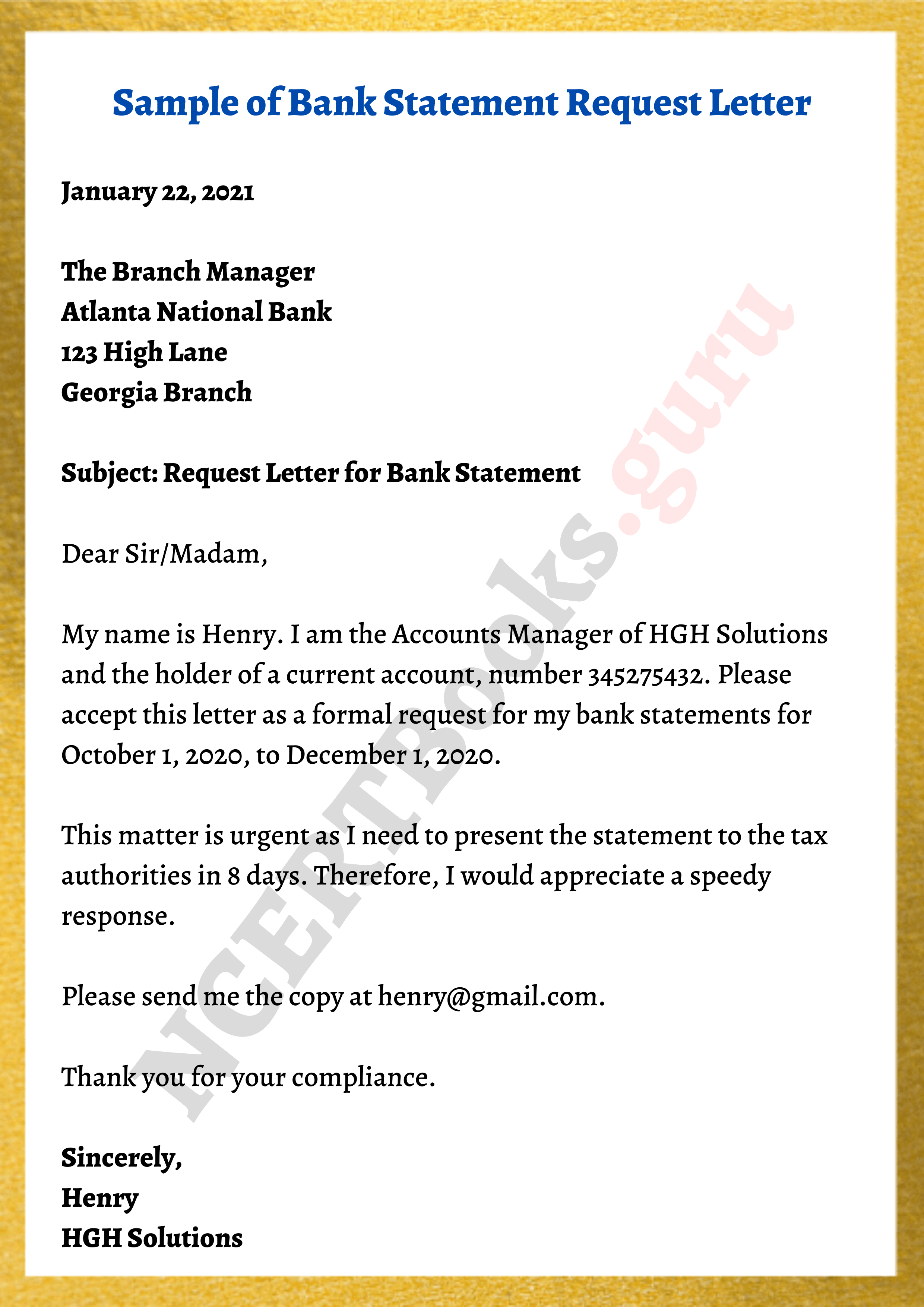

Image: www.ncertbooks.guru

Imagine this: you’re finally ready to buy your first home after years of saving. You’ve prepared all the necessary documents, but then you realize you need a recent bank statement to prove your financial stability. Now, you’re faced with the task of figuring out how to request it from your bank. This article aims to demystify the process of requesting a bank statement by providing a comprehensive guide and outlining the steps involved.

Understanding the Importance of Bank Statements

A bank statement is a crucial document that summarizes your financial transactions within a specific timeframe. It serves as a record of your deposits, withdrawals, and any other financial activity associated with your account. Bank statements are valuable for several reasons, including:

- Financial Tracking: They provide a clear overview of your income and expenses, helping you manage your money effectively and identify any discrepancies.

- Loan Applications: Lenders often require bank statements to assess your creditworthiness and financial stability before approving loans.

- Rent Verification: Landlords may ask for bank statements to verify your ability to pay rent, particularly if you’re looking for a new apartment or house.

- Tax Filing: When preparing your taxes, you may need bank statements to reconcile your income and expenses for accurate reporting.

- Proof of Payment: Bank statements can serve as evidence of payments you’ve made for various services or transactions.

Essentially, bank statements provide a detailed history of your financial activity, offering transparency and accountability. Whether you’re seeking to secure a loan, rent a property, or manage your finances effectively, having access to accurate and up-to-date bank statements is essential.

Writing a Letter to Your Bank Manager: A Step-by-Step Guide

There are several ways to obtain a bank statement, including online banking portals, ATMs, or by contacting your bank directly. However, writing a formal letter to your bank manager is a reliable and comprehensive approach, particularly if you require specific information or have complex requests.

1. Start with a Formal Salutation

Begin your letter by addressing the bank manager using a respectful salutation like “Dear [Bank Manager name]”. Ensure you use the correct name and title to maintain formality and professionalism.

Image: www.hotzxgirl.com

2. Introduce Yourself and Your Account Details

Clearly state your full name, account number, and the type of account you hold (e.g., savings, checking). This helps the bank manager quickly identify your account and process your request efficiently.

3. Specify Your Request

State your reason for requesting the bank statement clearly and concisely. For instance, you could write: “I am requesting a copy of my bank statement for the period between [start date] and [end date] for [purpose of statement]. If applicable, detail any specific requirements you may have, such as the number of copies or the format you prefer (e.g., electronic or paper copy).

4. Provide Additional Information (If Necessary)

If applicable, include any relevant details that might be helpful in processing your request. For example, if you’re applying for a loan, you could mention the specific lender or loan type you’re applying for.

5. Thank the Bank Manager and Sign Off

End your letter with a polite closing, expressing your gratitude to the bank manager for their time and assistance. For example, you could write, “Thank you for your time and consideration.” End with a formal closing like “Sincerely,” followed by your full name.

Example Letter Template

Below is an example letter template you can use as a starting point:

Dear [Bank Manager Name],

This letter is to request a copy of my bank statement for the account number [Account Number]. I require the statement for the period between [Start Date] and [End Date] for [Reason for Request].

I would appreciate it if you could send me a copy of the statement electronically to [Your Email Address].

Thank you for your time and assistance.

Sincerely,

[Your Full Name]

Tips and Expert Advice

1. Prioritize Promptness

It’s essential to contact your bank in advance of needing the bank statement, as processing times can vary depending on the bank and the complexity of the request. Allow ample time for the request to be processed and for the statement to be sent to you.

2. Double-Check All Details

Accuracy is crucial when requesting a bank statement. Carefully review your letter before sending it to the bank manager, ensuring that all details, including account numbers, dates, and contact information, are correct. Any errors could lead to delays or complications.

3. Explore Different Options

In addition to writing a formal letter, you can use other methods to obtain a bank statement, such as using your online banking portal or visiting your nearest branch. Explore the available options and choose the method that suits your needs and circumstances best.

Frequently Asked Questions (FAQ)

Q: How long does it take to receive a bank statement?

The processing time for a bank statement varies depending on the bank and the method of request. It can range from a few days to a week or more. Check with your bank for their specific processing guidelines.

Q: Are there any fees associated with obtaining a bank statement?

Some banks may charge a small fee for issuing a bank statement, particularly for expedited services or additional copies. However, many banks offer free statement services, especially for online requests. Contact your bank for specifics regarding their fee structure.

Q: Can I request a bank statement over the phone?

While you can inquire about your bank’s statement options over the phone, it’s generally advisable to submit a formal request in writing, ensuring a clear record of your request and the bank’s response.

Letter To Bank Manager For Bank Statement

Conclusion

Obtaining a bank statement is an essential task for various financial needs. While it might seem daunting at first, understanding the process and following the steps outlined in this guide can make it straightforward. By writing a clear and concise letter to your bank manager, you can ensure that your request is processed efficiently and you receive the documentation you need. Remember to be proactive, prioritize accuracy, and explore all available options for obtaining your bank statement.

Are you interested in learning more about bank statements or other aspects of personal finance? We encourage you to leave a comment below and share your thoughts and experiences!