Have you ever wondered what lies behind the opulent name “Crown Banking?” For many, the term conjures up images of gilded vaults and luxurious banking experiences fit for royalty. But what does it truly mean, and does it live up to the hype? In this comprehensive guide, we’ll delve into the fascinating world of Wells Fargo’s Crown Banking, exploring its features, benefits, and whether it truly is the “royal” banking solution it purports to be.

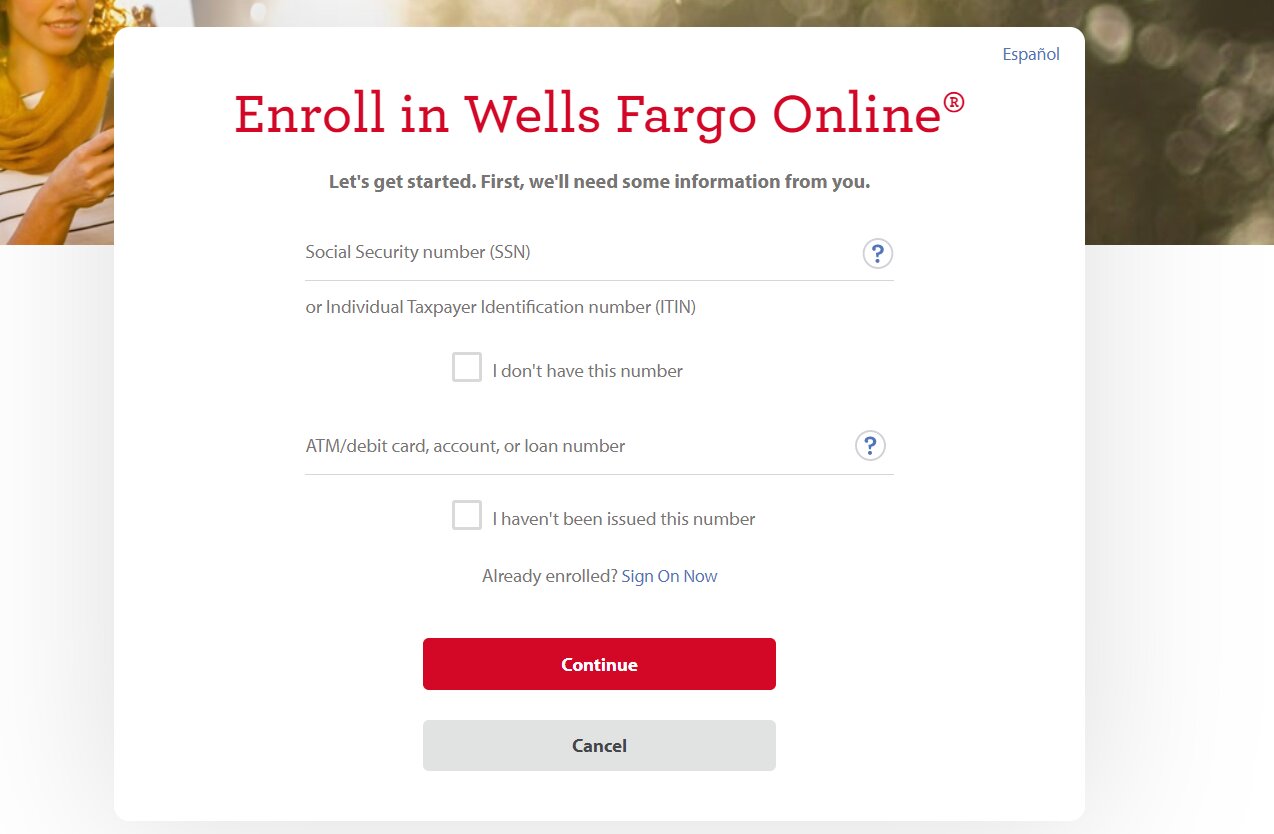

Image: fity.club

Wells Fargo Crown Banking, often referred to as a “private banking” service, caters to high-net-worth individuals and families seeking a personalized and exclusive approach to wealth management. It’s designed to offer a curated suite of financial services tailored to meet the unique needs of affluent clientele. This guide aims to illuminate the intricacies of Crown Banking, helping you understand its structure, fees, and the value proposition it offers.

Understanding the Crown Banking Concept

At its core, Crown Banking at Wells Fargo embodies a commitment to personalized, concierge-level financial services, prioritizing a deep understanding of its clients’ individual financial goals and aspirations. The program is designed to provide:

- Dedicated Relationship Managers: You’ll have a dedicated relationship manager who serves as your single point of contact, ensuring a consistent and personalized approach to managing your wealth.

- Tailored Investment Strategies: Crown Banking delivers bespoke investment strategies crafted to align with your specific financial objectives, risk tolerance, and time horizon.

- Comprehensive Wealth Management: Beyond investment management, Crown Banking encompasses a wide spectrum of financial services, including trust and estate planning, tax optimization, and insurance solutions.

- Exclusive Access and Perks: Members enjoy privileges like access to exclusive events, invitations to financial seminars, and personalized financial education programs designed to enhance financial literacy.

Crown Banking is not simply a collection of financial products; it’s an experience. It’s about having a team of experts who understand your unique financial journey and are committed to helping you achieve your financial aspirations. It’s about having a trusted advisor who guides you through complex financial landscapes and provides peace of mind.

The Costs of Crown Banking

While the benefits of Crown Banking are alluring, it’s crucial to understand the associated costs. Crown Banking is not a “one-size-fits-all” solution, and fees can vary significantly based on factors like the total value of your assets under management and the specific services you choose.

Some common fees associated with Crown Banking might include:

- Annual Fee: A yearly fee, typically assessed for maintaining your account.

- Asset Management Fees: A percentage-based fee on your assets under management, often charged for portfolio management services.

- Transaction Fees: Fees may apply for certain transactions, such as wire transfers or account maintenance.

- Advisory Fees: Fees charged for personalized financial advice or consultation.

Before considering Crown Banking, it’s essential to have a clear understanding of the fee structure and ensure it aligns with your overall financial strategy. Discussing fees openly with your potential relationship manager is crucial to determine whether the service justifies the cost.

Who Should Consider Crown Banking?

Crown Banking is designed for a select audience of individuals and families with substantial financial assets and complex financial needs. It’s not a service for everyone, and its benefits may not be fully realized by individuals with smaller portfolios or simpler financial situations.

Here are some key characteristics of individuals or families who might find Crown Banking beneficial:

- High Net Worth: Crown Banking typically requires a minimum threshold of assets under management, which can vary depending on the specific branch. This generally entails significant financial assets in the millions of dollars.

- Complex Financial Needs: If you have a diverse portfolio, including investments, real estate, trust assets, and other complex financial instruments, Crown Banking can provide dedicated expertise to manage these assets effectively.

- Desire for Personalized Support: Individuals who value a hands-on and personalized approach to wealth management and prefer a dedicated relationship manager might appreciate the tailored experience offered by Crown Banking.

- Strategic Wealth Planning: If you’re looking for comprehensive wealth planning, including tax optimization, estate planning, and financial legacy strategies, Crown Banking can offer a range of solutions tailored to achieving your long-term goals.

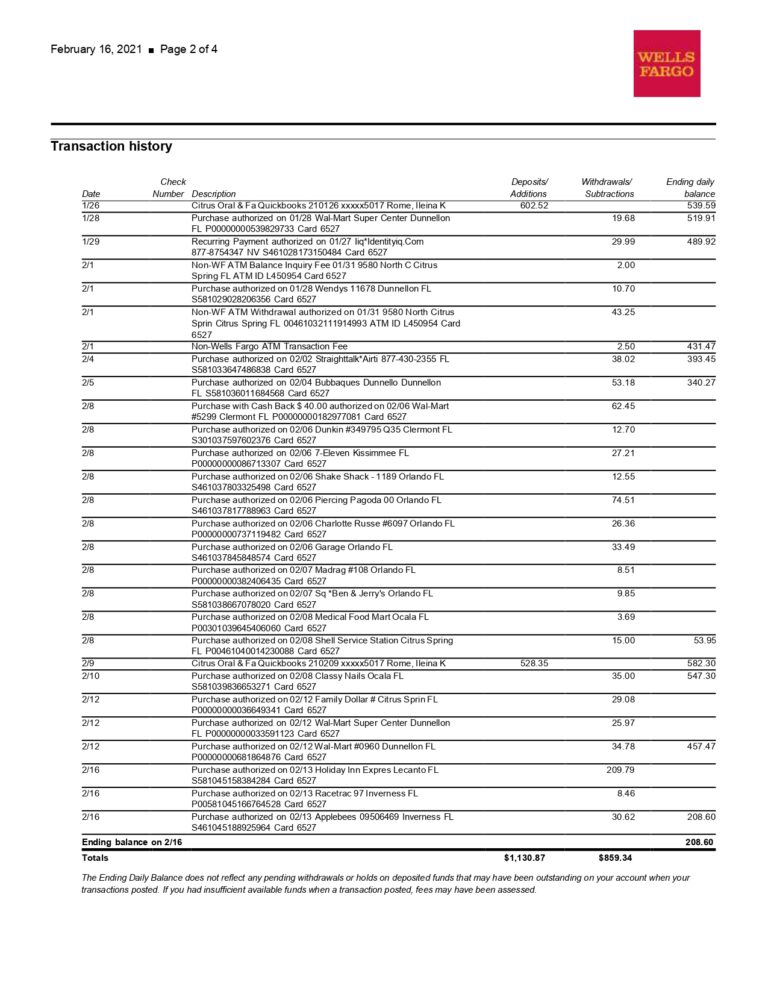

Image: mbcvirtual.com

Navigating the Crown Banking Experience

Before embarking on the Crown Banking journey, conducting thorough research and understanding the intricacies of the program is essential. You can gather information from official Wells Fargo resources, reputable financial websites, and even consider speaking with current Crown Banking clients to gain their perspectives on the experience.

Here are some key aspects to consider when exploring Crown Banking:

- Relationship Manager: It’s vital to find a relationship manager who aligns with your financial goals, communication style, and values. A thorough consultation with potential relationship managers can help you determine if there’s a good fit.

- Clear Communication: Open and transparent communication is vital in any financial relationship. Ensure you understand the fee structure, investment strategies, and service commitments before making any decisions.

- Investment Philosophy: It’s crucial to have a clear understanding of the investment philosophy and strategies employed by Crown Banking. This includes their approach to risk management, asset allocation, and performance expectations.

- Access to Services: Familiarize yourself with the range of financial services offered, including investment management, trust services, tax optimization, insurance, and any other services that may relate to your financial needs.

Wells Fargo Crown Banking Account Type

Conclusion: Choosing the Right Path

Ultimately, the decision to pursue Crown Banking is a personal one, informed by your specific financial circumstances, aspirations, and preferences. While it offers a comprehensive and exclusive approach to wealth management, it’s crucial to weigh the benefits against the costs and determine if it aligns with your long-term financial objectives. Whether you’re a high-net-worth individual seeking personalized financial guidance or simply exploring the possibilities of wealth management, comprehensive research and thoughtful consideration are key to making the best financial decisions.