I remember the day I got into a fender bender. I was driving home from work, feeling relieved that the week was over, when suddenly, a car pulled out in front of me. I slammed on my brakes, but it was too late. We collided, and though the damage was minimal, the whole situation left me feeling shaken. As we exchanged information, the police officer asked for something I hadn’t even considered before—an insurance code. This was the start of my journey into the world of police report insurance codes, and it was a journey I quickly realized other drivers might find helpful.

Image: www.dochub.com

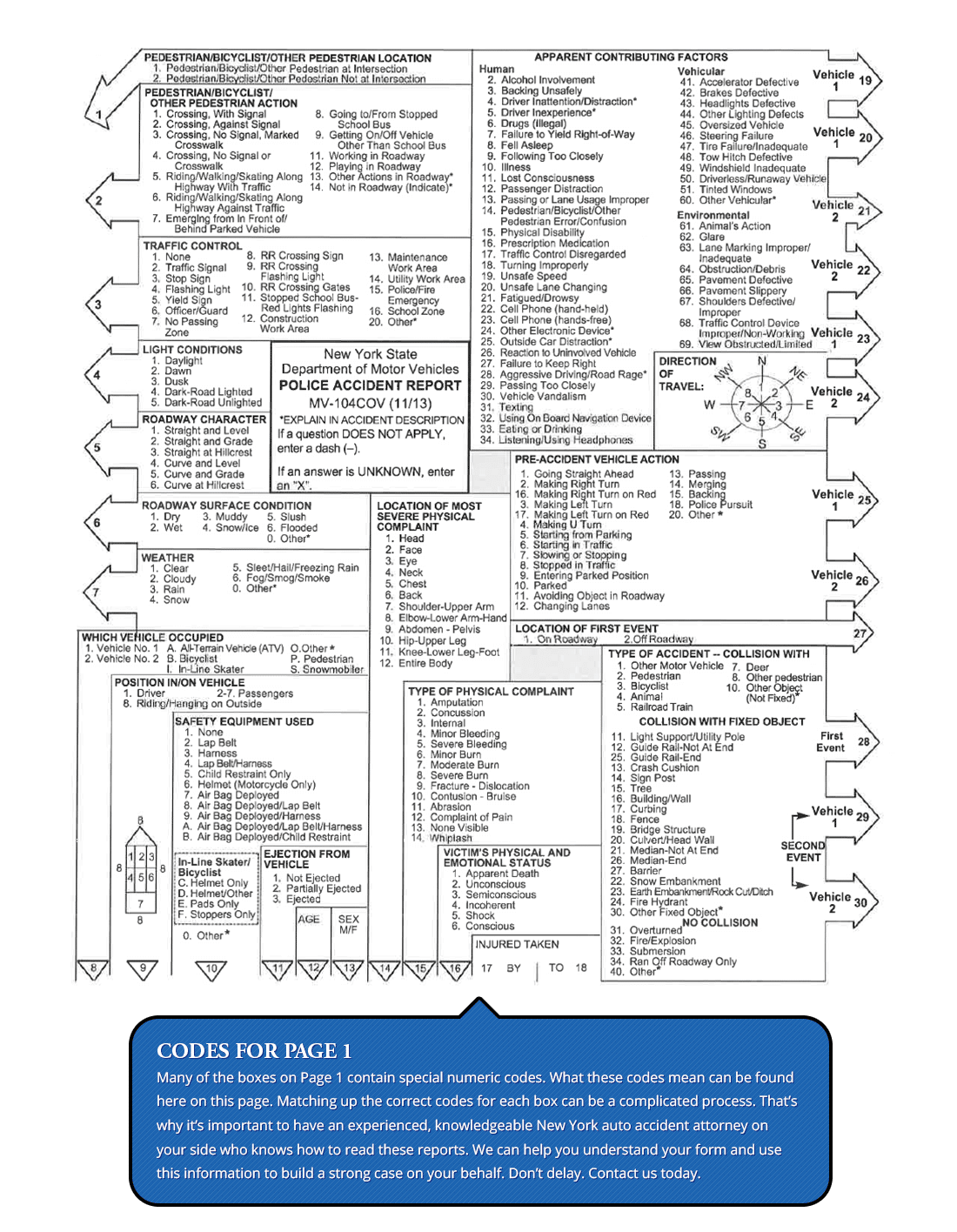

The officer explained that these codes, often referred to as “police report incident codes,” helped insurance companies assess the severity of accidents and potentially expedite the claims process. It made sense, but I couldn’t help but wonder how these codes were structured, their practical significance, and how they impacted my own insurance claim.

Decoding the Language of Police Report Insurance Codes

In New Jersey, the police department uses a standardized system of insurance codes to classify different types of accidents, incidents, and events. These codes can provide valuable information to insurance companies, as they can help them understand:

- The nature of the incident: Did this involve a collision, a hit and run, or a fire?

- The severity of the incident: Does it require a full police report, involve injuries, or result in significant property damage?

- The circumstances surrounding the accident: Were there any contributing factors, such as drunk driving or reckless driving?

Understanding the Importance of Accuracy

Police officers are trained to accurately assign these codes based on the information gathered at the scene. The accuracy of the code is vital, as it can directly influence the insurance claim. An incorrect code could lead to delays in processing the claim or even denial of coverage. In cases where there are disagreements about the codes, drivers have the right to appeal the decision to the police department.

Navigating the Code System

The New Jersey police report insurance codes are not publicly available to the general public. However, insurance companies have access to these codes through specialized databases. It’s important to note that the specific codes used in New Jersey might vary slightly from other states, so always consult with the local police department for detailed information.

While it’s generally not necessary for drivers to know every single code, being familiar with the basic categories can help you understand the police report better and prepare for potential insurance claims. Some common categories include:

- Motor Vehicle Collisions: These codes are used to classify accidents involving two or more vehicles.

- Property Damage: Codes in this category are used for accidents that damage property, such as a vehicle striking a fence or a building.

- Injuries: Codes related to physical or mental injuries resulting from an incident.

- Hit and Runs: These codes are used for incidents where a vehicle leaves the scene without identifying itself or providing contact information.

Image: whoamuu.blogspot.com

The Impact of Codes on Insurance Claims

The insurance codes used in police reports play a significant role in the claims process. Insurance companies often use these codes as a basis for investigating a claim and determining liability. Codes related to serious accidents involving injuries or significant property damage may trigger a more thorough investigation and could potentially lead to higher insurance premiums for the driver at fault.

A Guide to Best Practices

While you can’t control the code assigned by the police, there are steps you can take to ensure that the information is accurate and comprehensive. Here are some tips for drivers involved in an accident:

- Stay calm and cooperative: This will help the police officer gather all the necessary details to assign the appropriate code.

- Provide accurate information: Be truthful and thorough when providing information about the accident. This includes details about the other vehicle, any witnesses, and the circumstances surrounding the incident.

- Document the incident: Take pictures or videos of the damage, the scene, and any injuries. This evidence can crucial in supporting your claim and ensuring accurate code assignment.

- Request a copy of the report: This will provide a record of the incident, including the insurance code assigned, and can be useful for future reference.

Navigating the Claims Process

Once you have a copy of the police report, contact your insurance company immediately. Provide them with all relevant information, including the incident codes. Your insurance company will then use this information to initiate the claims process. If there are any discrepancies in the codes or the information reported, it’s crucial to address these issues directly with your insurance company and the police department as soon as possible.

FAQs about New Jersey Police Report Insurance Codes

Here are some frequently asked questions about police report insurance codes in New Jersey:

Q: What happens if the police officer assigns an incorrect code?

A: You can request a review of the code assignment from the police department. Provide evidence supporting your claim, and they will assess the situation and might adjust the code accordingly.

Q: Can I access the insurance code database myself?

A: No, the police report insurance code database is not publicly available. Your insurance company has access to this information.

Q: How do insurance codes impact my insurance premiums?

A: Codes indicating a higher severity of the accident could potentially lead to increased premiums, especially if you are found at fault.

Q: Is it possible to appeal a code assigned to me?

A: Yes, you can appeal the code to the police department, but you must provide sufficient evidence to support your request.

New Jersey Police Report Insurance Codes

Conclusion

Understanding the New Jersey police report insurance code system is essential for drivers involved in accidents. These codes play a crucial role in insurance claims, and accurate information can help ensure a smoother and more efficient process. By staying informed about the different code categories, following best practices, and seeking clarification when needed, you can navigate the aftermath of an accident with greater confidence.

Do you have any specific questions or experiences related to police report insurance codes? Share your thoughts in the comments section below.