Have you ever found yourself in a situation where you needed to claim money on someone else’s behalf? Perhaps you were handling a deceased relative’s affairs, or maybe a friend asked you to manage their financial matters while they were away. In these scenarios, an authorization letter is crucial to legitimize your actions and ensure a smooth process. This letter serves as your official permission to act on behalf of another individual, allowing you to access and manage their funds.

Image: tupuy.com

While the concept itself seems straightforward, crafting a legally sound and convincing authorization letter can be tricky. This guide will provide you with all the necessary information to understand the importance of this letter, along with a sample to help you create your own document with confidence.

Understanding Authorization Letters for Claiming Money

What is an Authorization Letter?

An authorization letter is a formal document that grants an individual (the authorized representative) the right to act on behalf of another person (the principal) in specific financial matters. It typically includes details about the specific actions the representative is allowed to undertake, the amount of money involved, and the timeframe for which the authorization is valid.

Why are These Letters Necessary?

Authorization letters are essential for several reasons:

- Proof of Legitimate Representation: They provide clear evidence that the authorized representative is acting with the principal’s consent, preventing any potential disputes or misunderstandings.

- Protection from Liability: By having a written authorization, both the principal and the representative are safeguarded from legal issues that might arise.

- Streamlined Processes: They simplify financial transactions, allowing authorized representatives to claim money, access accounts, and make transactions efficiently.

Image: tupuy.com

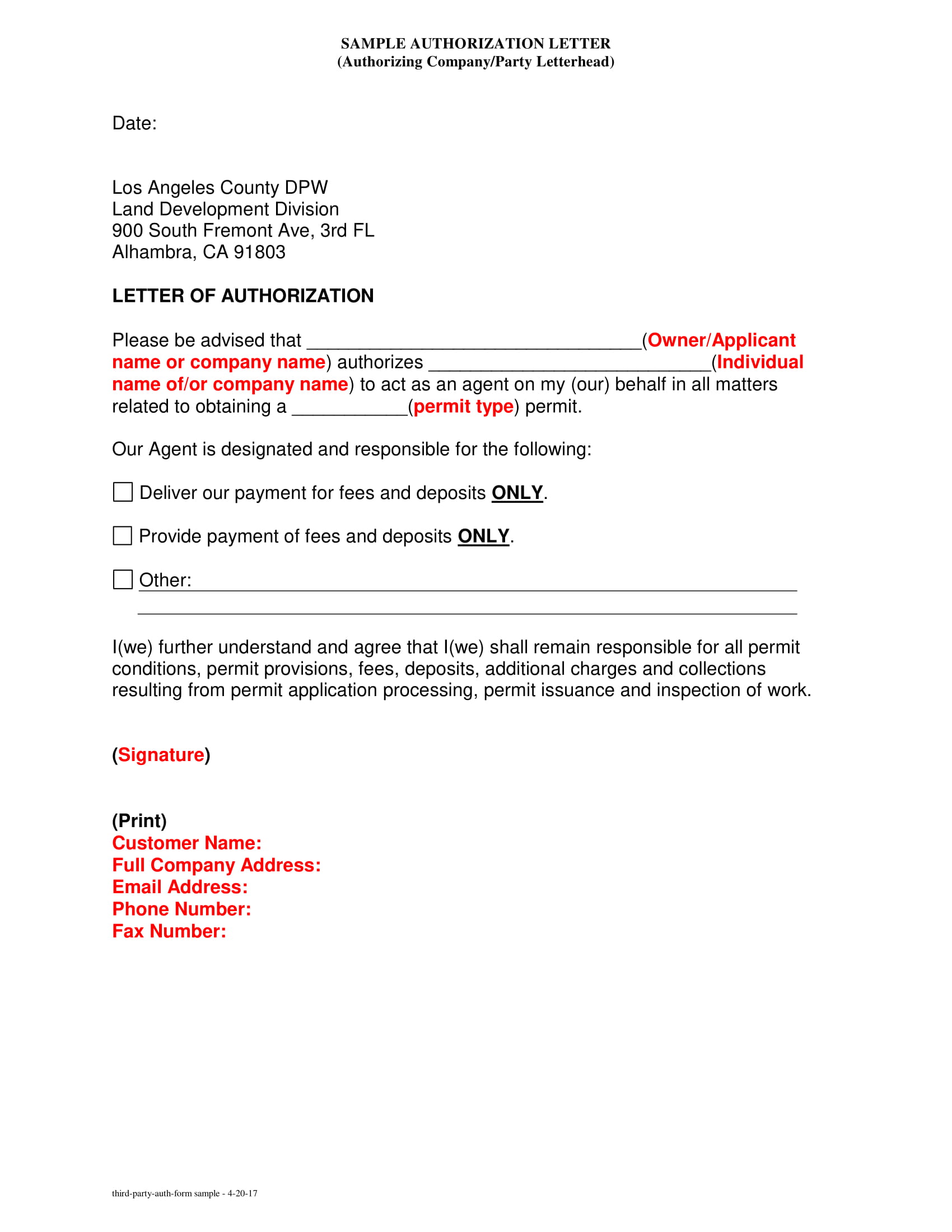

Important Elements of an Authorization Letter

A well-crafted authorization letter should include the following key elements:

- Your Name and Contact Information: Clearly state your name and address as the authorized representative.

- Principal’s Name and Contact Information: Provide the full name and contact information of the individual you are representing.

- Purpose of the Authorization: Specify the specific reason for the authorization, such as claiming funds from a bank account, receiving insurance payouts, or managing investments.

- Scope of Authorization: Define the exact actions you are authorized to perform, outlining any limitations or restrictions.

- Amount of Money: Clearly state the maximum amount of money you are authorized to claim.

- Validity Period: Specify the date from which the authorization is valid and when it expires.

- Principal’s Signature: The authorization must be signed by the principal, who should also date the document.

- Witness Signature (optional): A witness can sign to verify the principal’s signature.

Sample Authorization Letter:

Here is a sample authorization letter that you can use as a template:

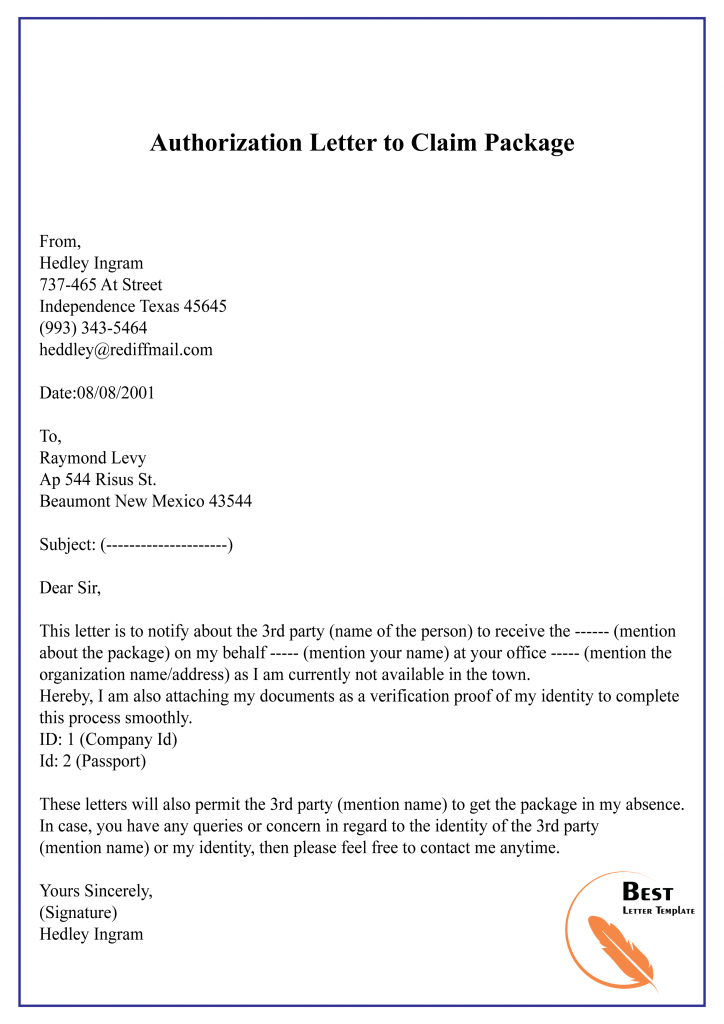

[Date]

To Whom It May Concern,

This letter serves as authorization for [Your Full Name], residing at [Your Address], to claim funds belonging to [Principal’s Full Name] residing at [Principal’s Address].

I, [Principal’s Full Name], hereby authorize [Your Full Name] to claim [Amount of Money] from [Source of Funds] on my behalf. This authorization is valid for [Validity Period].

I will be solely responsible for any activities undertaken by [Your Full Name] under this authorization.

Sincerely,

[Principal’s Signature]

[Witness Signature (Optional)]

Tips for Crafting a Strong Authorization Letter

Here are some tips for crafting an effective authorization letter that minimizes potential issues and ensures a smooth claim process:

- Be Specific: Clearly define the purpose, scope, and amount covered by the authorization to avoid ambiguity.

- Use Legible Language: Employ simple, clear language to ensure that the letter is easy to understand for everyone involved.

- Include Dates: Ensure that all dates are accurate and clearly stated to avoid any confusion regarding the validity of the authorization.

- Document Everything: Keep a detailed copy of the authorization letter, including any supporting documentation, for your records.

- Seek Legal Advice (if needed): For complex financial situations or large sums, consult an attorney to ensure that the authorization letter fulfills all legal requirements.

Frequently Asked Questions

Q: What if I need to claim money for a deceased person?

A: You’ll need to provide a death certificate and a copy of the will, if applicable, along with the authorization letter to claim the funds. Additional documentation may be required depending on the specific situation.

Q: Can I authorize someone to claim money from my bank account?

A: Yes, but you may need to provide additional information, such as your Social Security number, to the bank.

Q: Should I notarize this letter?

A: While not always required, notarization can add an extra layer of security and legitimacy to your authorization, especially when dealing with large sums of money.

Authorization Letter Sample To Claim Money

Conclusion

An authorization letter is a vital tool for representing individuals in financial matters. By understanding the necessary components, crafting a clear and comprehensive letter, and following the tips provided, you can ensure that your claim is processed smoothly and without unnecessary delays.

Interested in learning more about authorization letters? Let us know in the comments below!