You’ve poured over textbooks, conquered countless practice questions, and finally, the day of the CFA Level 1 exam is looming. There’s a single, undeniable constant that’ll be by your side: the formula sheet. But is it just a collection of cryptic symbols, or a hidden weapon in your arsenal? The answer is a fascinating blend of both, and understanding how to leverage it is crucial.

Image: www.sanctuaryvf.org

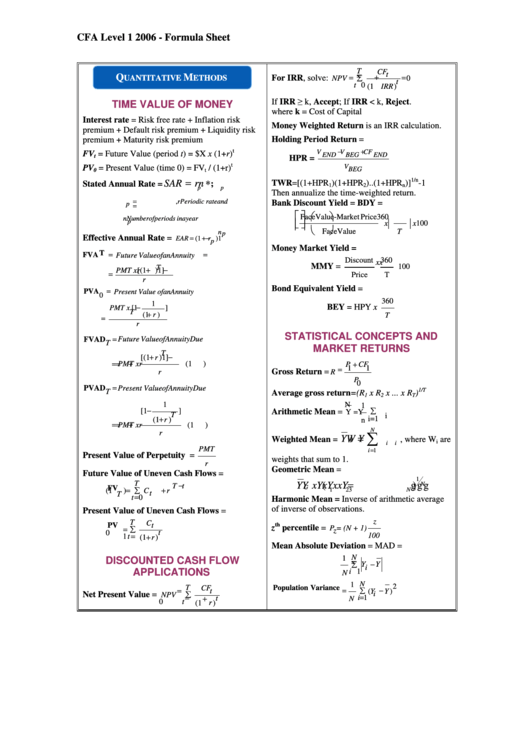

The CFA Level 1 formula sheet, provided by the CFA Institute, contains a compilation of essential formulas across the diverse subjects of the exam. It’s a lifeline for candidates, offering quick access to key calculations and saving precious time during the test. However, mere possession is insufficient; true mastery lies in knowing when, where, and how to utilize each formula effectively.

Unveiling the Power of the CFA Level 1 Formula Sheet

Beyond Formulas: A Comprehensive Guide

The formula sheet, though indispensable, is not a substitute for in-depth understanding. Instead, it should be viewed as a valuable companion, complementing your knowledge base. Proficiency in applying each formula requires a firm grasp of its underlying concepts and contextual implications. Imagine it as your trusted toolkit: you need to understand what each tool does and how it works in different scenarios.

The Art of Formula Mastery

True formula mastery involves more than just rote memorization. It demands a deeper understanding of their application in context, allowing you to identify and solve problems efficiently. Here’s a breakdown of key strategies:

- Practice, Practice, Practice: The more you apply formulas to practice questions, the more comfortable and confident you’ll become. This repetitive exposure strengthens your understanding and allows you to swiftly recall the correct formula in the heat of the exam.

- Active Learning: Don’t passively glance at the formula sheet. Actively engage with it. Try deriving the formulas yourself, understand the variables involved, and analyze how each formula relates to other concepts you’ve learned.

- Mind Maps and Cheat Sheets: Create custom mind maps or cheat sheets that organize formulas logically. This visual approach helps you navigate the formula sheet swiftly during the exam by establishing clear connections between formulas and topics.

- Key Formula Identification: While the formula sheet provides a comprehensive list, not all formulas are equally important. Pinpoint the most frequently used formulas in each section and prioritize their mastery. This strategic approach avoids unnecessary stress and helps focus your efforts effectively.

Image: diendantailieu.com

Navigating the Formula Landscape: A Breakdown

The CFA Level 1 formula sheet is structured into sections, with each section pertaining to a specific topic covered in the exam. This organization provides a clear and logical flow, allowing you to navigate the sheet efficiently.

Here’s a glimpse into the key sections within the 2024 formula sheet:

- Ethical and Professional Standards: While this section may not appear to be formula-heavy, understanding the Code of Ethics and Standards of Professional Conduct is paramount for ethical decision-making. The formula sheet highlights relevant definitions and key principles for you to refer to.

- Quantitative Methods: This section contains formulas for statistical calculations, such as probability, hypothesis testing, and regression analysis. It’s crucial to understand the nuances of these calculations and their applications in financial decision-making.

- Financial Reporting and Analysis: The formula sheet for this section provides a comprehensive set of formulas related to financial statement analysis, including ratios, cash flow statements, and common-size analysis. Mastering these formulas is essential for understanding the financial health and performance of companies.

- Corporate Finance: This section covers concepts such as capital budgeting, valuation, and cost of capital. You’ll find formulas for calculating net present value (NPV), internal rate of return (IRR), and other key metrics used in investment decisions.

- Portfolio Management: This section delves into portfolio construction, asset allocation, and performance evaluation. Formulas include those for calculating portfolio return, risk, and performance measures such as Sharpe ratio and Treynor ratio.

- Equity Investments: This section involves the valuation and analysis of equity securities. Formulas include those for calculating dividend discount models, free cash flow models, and other metrics for evaluating individual stocks and the broader market.

- Fixed Income: This section focuses on the valuation and analysis of fixed income securities. Formulas include those for calculating yield to maturity (YTM), duration, and convexity, which are crucial for understanding bond pricing and risk management.

- Derivatives: This section covers the valuation and analysis of derivatives, including options, futures, and forwards. You’ll find formulas for calculating option values, futures prices, and other metrics essential for understanding the intricacies of derivative markets.

- Alternative Investments: This section explores the valuation and analysis of alternative investment strategies, including real estate, private equity, and hedge funds. Formulas include those for calculating IRR, cash flow multiples, and other metrics specific to alternative asset classes.

Beyond Memorization: The Power of Application

The Key to Success: Practice and Contextualization

While the formula sheet provides a valuable framework, true success lies in applying your knowledge to real-world scenarios. Consider each formula as a tool in your financial analysis toolbox, capable of unlocking insights and driving informed decisions.

In practice, you’ll often find that formulas can be combined or adapted to suit specific situations. This adaptability is where your understanding of the underlying principles truly shines. The CFA Level 1 exam emphasizes analytical thinking and problem-solving skills, going beyond mere formula memorization.

Putting Theory into Practice: Real-World Insights

Take, for instance, the formula for calculating NPV. This formula is essential for evaluating investment projects. However, its application goes beyond simply plugging in numbers. It requires a deep understanding of project cash flows, discount rates, and risk adjustments. By combining your understanding of the NPV formula with your knowledge of financial concepts like WACC (weighted average cost of capital), you can make informed decisions regarding capital budgeting and investment choices.

Similarly, the formulas for calculating beta and correlation in the portfolio management section are vital for understanding portfolio risk and diversification strategies. A firm grasp of these formulas, combined with your knowledge of market risk, allows you to make strategic decisions about asset allocation, hedging strategies, and risk management techniques.

Master the Formula Sheet: The Gateway to Success

A Guide to Success: Don’t Underestimate the Formula Sheet’s Power

The CFA Level 1 formula sheet is a valuable tool that, when wielded effectively, can dramatically enhance your exam preparation and performance. Remember, it’s not just about memorizing formulas, but about understanding their underlying concepts, applications, and how they fit into the broader context of financial analysis. By embracing a proactive approach to formula mastery, you’ll not only increase your chances of success on the exam but also gain valuable insights that will serve you throughout your financial career.

Beyond the Exam: A Foundation for Long-Term Success

The CFA Level 1 formula sheet is more than just a resource for the exam; it’s a gateway to a powerful knowledge base that you can leverage throughout your career. Understanding the formulas and their underlying concepts equips you with the tools to navigate complex financial situations, analyze data effectively, and make insightful decisions in a data-driven world.

Cfa Level 1 2024 Formula Sheet

A Journey of Growth: Embrace the Challenges Ahead

The CFA Level 1 exam is a challenging but rewarding journey. Embrace the challenge, dedicate yourself to mastering the formula sheet, and remember that success is a combination of knowledge, preparation, and a genuine passion for finance. The journey will be demanding, but the rewards of achieving the CFA designation are immeasurable. Good luck with your studies, and may your formula sheet be your trusted companion on the path to success.