Imagine walking into a bustling market, filled with vendors showcasing their wares. You see a stall overflowing with exotic spices, another bursting with vibrant, hand-woven fabrics, and a third filled with intricately crafted jewelry. Each stall, in a way, represents a company, showcasing its products and services. But how do you determine the overall value of each stall, or, in business terms, each company?

Image: www.chegg.com

This is where the concept of ‘market capitalization’ or simply ‘market cap’ comes into play. It’s a crucial metric that helps us understand the overall worth of a publicly traded company. But what exactly does market cap mean? How is it calculated? And why is it so important?

What is Market Capitalization?

Market capitalization, often shortened to “market cap,” is the total value of the outstanding shares of a publicly traded company. It essentially tells us the company’s worth in the eyes of the market. Imagine a company like Apple, with millions of shares trading on the stock market. To calculate Apple’s market cap, we multiply the current share price by the total number of shares outstanding. If Apple’s share price is $150 and it has 16.4 billion shares outstanding, its market cap would be $2.46 trillion (150 x 16.4 billion).

Understanding the Importance of Market Cap

Market cap is a fundamental metric in the world of finance for several reasons:

- Size and Scale: Market cap provides a quick gauge of a company’s size and its overall influence in its industry. A larger market cap typically indicates a more established and influential company.

- Investment Appetite: This metric can give investors an idea of the size of the investment needed to acquire a significant stake in the company. A higher market cap company might require substantial capital investment for a controlling stake, while a smaller company could be acquired with a smaller investment.

- Growth potential: Market cap can be used to identify companies with high growth potential. While a company’s current market cap might be relatively small, its growth trajectory and future potential could lead to a significant increase in its market cap over time.

- Comparative Analysis: Market cap allows investors to easily compare companies within the same industry. This helps them make informed decisions about which companies are worth investing in, based on their size, financial health, and potential for growth.

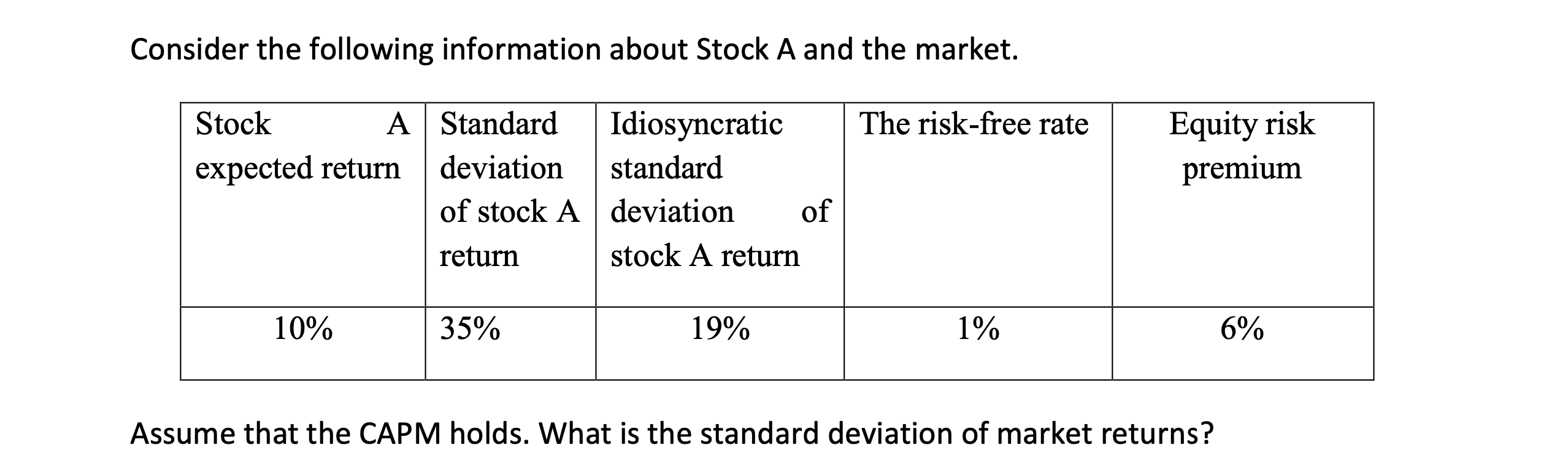

Key Formulas and Calculations

Understanding the formula for calculating market cap is crucial for any investor who wants to make informed decisions. Here’s a simple breakdown of the calculation:

Image: www.chegg.com

Market Cap = Current Share Price x Total Number of Outstanding Shares

Here’s a real-world example to illustrate this formula. Let’s say a company called XYZ Corp has a current share price of $50, and it has 10 million shares outstanding. Here’s how we would calculate the market cap:

Market Cap = $50 x 10,000,000 = $500,000,000

Therefore, XYZ Corp’s market cap is $500 million. This metric becomes a key indicator of how the market perceives the value of the company.

Market Cap in Different Contexts

Market cap is a versatile metric used in a variety of contexts in the financial world:

- Investor Classification: Market cap helps classify companies based on their size. Investors often use these classifications to create investment portfolios:

- Mega-cap: Companies with a market cap above $200 billion. Examples include Apple, Microsoft, and Amazon.

- Large-cap: Companies with a market cap between $10 billion and $200 billion. Think of companies like Walmart, JPMorgan Chase, and Johnson & Johnson.

- Mid-cap: Companies with a market cap between $2 billion and $10 billion. Examples include Chipotle Mexican Grill, Autodesk, and Marathon Petroleum.

- Small-cap: Companies with a market cap between $300 million and $2 billion. Examples include Catalent, Xometry Inc., and CarMax.

- Micro-cap: Companies with a market cap below $300 million. Examples include Cassava Science, Catalent, and Planet Labs.

- Risk Management: Market cap helps investors assess the risk of investing in a company. Generally, larger companies with higher market caps are considered less risky than smaller companies, as they tend to have more stable earnings and a solid financial track record.

- M&A Activity: Market cap is a crucial factor when determining the value of a company during mergers and acquisitions. It helps potential acquirers assess the target company’s value and negotiate a fair price.

- Investment Strategies: Market cap plays a significant role in a variety of investment strategies, including value investing, growth investing, and index tracking.

Latest Trends and Developments

Market capitalization is a constantly evolving metric, influenced by a multitude of factors including economic trends, industry performance, company-specific events, and investor sentiment. In recent years, we’ve seen some notable trends impacting market cap:

- Rise of Technology Companies: The rapid growth of technology companies has significantly impacted market caps. Companies like Apple, Microsoft, Amazon, and Google have seen their market caps skyrocket in recent years, driven by their dominance in their respective industries and consistent innovation.

- Impact of Global Events: Global events, such as pandemics, political instability, and economic downturns, can have a significant impact on market caps. During times of uncertainty, investors tend to sell off their holdings in riskier companies, leading to declines in market cap.

- Increased Volatility: Market caps have become increasingly volatile in recent years, fueled by factors like social media, news cycles, and rapid technological advancements. This volatility can create opportunities for investors, but it also comes with increased risk.

- The Growth of ESG Investing: The rise of ESG (Environmental, Social, and Governance) investing has led to increased scrutiny of companies’ environmental impact, social responsibility, and corporate governance practices. Companies with strong ESG practices are often rewarded with higher market caps, while others facing significant ESG challenges could see their market caps decline.

Tips and Expert Advice: Navigating the Market Cap Landscape

Understanding market cap is a valuable skill for any investor. Here’s some expert advice on how to leverage this metric effectively:

- Don’t be misled by market cap alone: Market cap is a useful metric, but it’s not a complete picture. Remember, a company’s market cap is only one data point among many to consider when making investment decisions.

- Deeper Dive: Always delve beyond market cap to understand a company’s financials, growth prospects, competitive landscape, and management team.

- Focus on fundamentals: Market cap can be influenced by short-term factors like market sentiment. Focus on companies with strong fundamentals, like robust revenue growth, healthy profitability, and a solid track record.

- Consider your risk tolerance: Large-cap companies are generally less risky than small-cap companies. Remember your investment goals and your risk tolerance when making investment choices.

- Monitor market trends: Stay informed about the latest developments in the financial markets, economic trends, and industry-specific news. This awareness can help you make better-informed investment decisions and adjust your portfolio as needed.

FAQ: Frequently Asked Questions About Market Cap

Let’s address some common questions about market cap:

Q: What does a high market cap mean for a company?

A high market cap usually indicates a company with a large size, significant influence in its industry, and a strong market position. It can also imply that the company is considered well-established and financially stable. Investors might view companies with high market caps as having less risk associated with them, as they have a proven track record and a larger capital base.

Q: What does a low market cap mean?

A low market cap can indicate a smaller company with potentially higher growth potential but also a higher level of risk. While smaller companies might not have the financial resources of larger corporations, they have the opportunity to grow rapidly and disrupt existing industries. Investors seeking higher returns might be drawn to companies with lower market caps, but they must be prepared for higher volatility and potential losses.

Q: Does market cap change over time?

Yes, market cap is a constantly evolving metric. It can change rapidly based on various factors, including the company’s financial performance, industry trends, investor sentiment, and economic conditions. When a company’s share price increases, its market cap also rises; conversely, a decrease in share price will lead to a decline in market cap.

Q: What is the relationship between market cap and stock price?

Market cap and stock price are directly linked. A company’s market cap is calculated by multiplying its share price by the total number of outstanding shares. As the stock price fluctuates, the market cap will fluctuate accordingly. For example, if a company’s share price doubles, its market cap will also double.

Q: Is market cap the only factor to consider when investing?

No, market cap is only one piece of the puzzle. While market cap provides valuable insight into a company’s size and market standing, it’s crucial to conduct comprehensive due diligence before making any investment decisions. Factors like financial performance, management quality, growth potential, and industry trends all play a significant role in determining a company’s true value.

Which Of The Following Expressions Accurately Describes Market Cap

https://youtube.com/watch?v=CAp1IfzRh3U

Conclusion

Understanding ‘Market Cap’ can be a valuable asset for both novice and experienced investors. It offers a glimpse into the market’s perception of a company’s worth, providing a quick measure of size, growth potential, and risk. It’s essential to remember that market cap is just one piece of the puzzle. Investors should conduct thorough research, consider a company’s fundamentals, and always assess their own risk tolerance before making any investment decisions.

Do you find the concept of market cap intriguing? Are there any specific questions you have about this important metric? I’d love to hear your thoughts and engage in a conversation about this fundamental aspect of the financial world. Let’s continue the discussion!