Have you ever wondered how someone could fake their bank account balance? It’s a question that has crossed many people’s minds, especially in an age where online banking and digital transactions are the norm. The idea of someone manipulating their bank account balance to appear wealthier or to deceive others might seem like something out of a movie, but the reality is, it’s not as far-fetched as you might think.

Image: bigthinkcapital.com

In today’s digital world, where technology intertwines with our financial lives, it’s easy to see how someone might be tempted to manipulate their bank balance. Whether it’s to impress friends, secure a loan, or even to partake in fraudulent activities, the urge to feign a higher balance can be alluring. But before delving into the details, it’s important to understand the ethical and legal ramifications of attempting to fake your bank account balance. Not only is it illegal, but it also carries severe consequences.

The Truth about Fake Bank Account Balances

Understanding the Reality

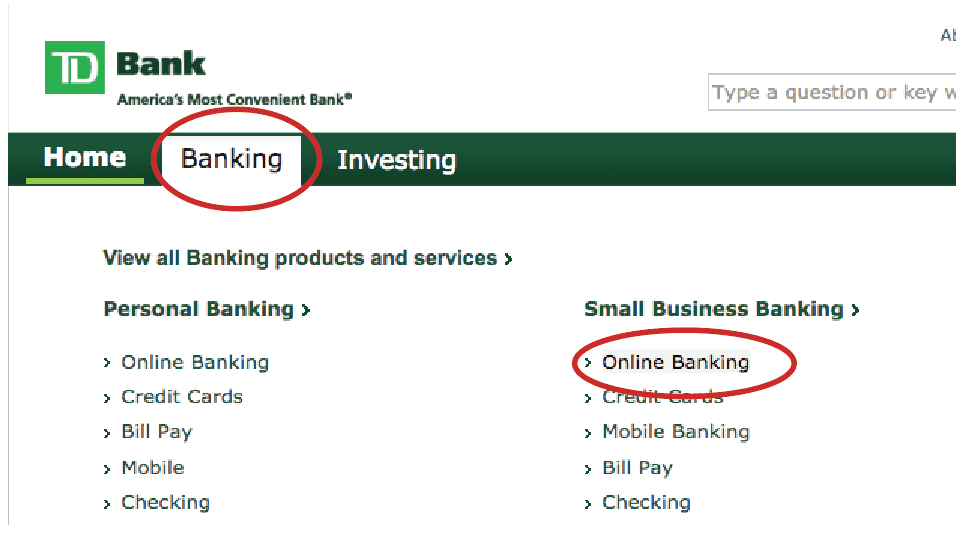

The idea of a fake TD Bank account balance might conjure up images of elaborate hacking schemes, but in reality, it’s usually much simpler (and often less successful). The most common method involves manipulating online banking interfaces or creating forged documents. These methods might seem like quick fixes, but the truth is, they’re extremely risky and can lead to serious legal trouble.

Imagine a situation where an individual decides to use Photoshop to create a fake bank statement, altering the balance to appear higher. While this might seem like a clever trick, banks and financial institutions have sophisticated software and fraud detection systems that can easily identify such fakes. An attempt to present a forged document could lead to criminal charges, fines, and even imprisonment.

The Ethical Implications

Beyond the legal ramifications, it’s crucial to consider the ethical implications of faking a bank account balance. Trust is the cornerstone of any financial transaction, and deliberately manipulating financial records violates that trust. Think of the consequences if someone were to trust you based on a fake balance and then suffer financial losses as a result. The betrayal of trust can have far-reaching consequences, affecting not only the individuals involved but also harming the broader financial system.

Image: travelwithgrant.boardingarea.com

The Risks Associated with Fake Bank Account Balances

The risks associated with attempting to fake a bank account balance are numerous and significant. Here are some potential consequences that individuals should be aware of:

- Legal Action: Attempting to deceive financial institutions or individuals with a fake bank balance is a serious offense and can result in criminal charges. The consequences can range from hefty fines to prison sentences.

- Reputation Damage: Once exposed, the individual’s reputation in the financial world will be irreparably tarnished. This could make it challenging to secure loans, open new accounts, or even find employment in certain industries.

- Loss of Trust: The individual will likely lose the trust of friends, family, and business associates. This loss of trust can have a lasting impact on their personal and professional life.

- Financial Losses: Depending on the nature of the attempted fraud, individuals might face financial losses as well. This could include the loss of funds, fines, legal fees, and potential financial penalties.

- Possible Blacklisting: Financial institutions often share information about fraudulent activities, and individuals attempting to fake their balance could be blacklisted from access to services. This could make it difficult to manage their finances in the future.

The Importance of Honesty and Integrity

The temptation to fake a bank account balance might seem appealing, but it’s essential to remember that honesty and integrity are paramount in the financial world. Building a strong financial foundation requires trust, transparency, and responsible financial practices. It’s far better to focus on genuine financial growth and stability through hard work, responsible savings, and wise financial decisions. Remember, success is built on solid foundations, not fabricated illusions.

The Evolution of Financial Security

From Physical to Digital: A Shift in Financial Landscape

In the past, banking primarily involved physical transactions at branches. The introduction of online banking revolutionized the way people manage their finances, offering convenience and flexibility. While this shift has had numerous benefits, it has also created new opportunities for potential fraud and security risks. The ease with which one can access financial information online has made it more challenging to prevent malicious activities, including attempts to manipulate account balances.

The Role of Technology in Fraud Detection

Fortunately, technology has also provided solutions to combat financial fraud. Banks and financial institutions are continuously investing in sophisticated security systems and fraud detection technologies. These systems leverage algorithms, artificial intelligence, and advanced analytics to monitor transactions and identify suspicious activities. While these systems are effective in detecting many fraudulent attempts, it’s a constant arms race as criminals are continually devising new ways to outsmart security measures.

The Impact on Consumer Awareness

The increased reliance on online banking has also raised awareness among consumers. Individuals are now more likely to understand the potential risks and take proactive steps to protect their financial information. Practices like using strong passwords, avoiding suspicious links, and periodically reviewing online banking statements have become increasingly common.

The Future of Financial Security

The future of financial security is likely to be shaped by continued advancements in technology. This will include the development of more sophisticated fraud detection systems, enhanced authentication measures, and potentially even the use of blockchain technology to create secure and tamper-proof records. While technology is playing a major role in safeguarding our finances, it’s also vital to remain vigilant and informed. Understanding the risks and practicing responsible financial habits is crucial in ensuring the security of our accounts.

Tips for Responsible Financial Management

Understanding the Importance of Secure Practices

Protecting your bank account balance requires vigilance and a commitment to responsible financial practices. It’s crucial to understand the potential risks and take proactive steps to prevent fraud. Here are some essential tips to safeguard your finances:

- Strong Passwords: Use strong and unique passwords for your online banking accounts. Avoid using common words or personal information that is easily guessable.

- Multi-Factor Authentication: Enable multi-factor authentication (MFA) whenever possible. This adds an extra layer of security by requiring you to enter a unique code after entering your password.

- Secure Wi-Fi Connections: Avoid using public Wi-Fi networks for online banking transactions. Use a secure and reliable network at home or in a trusted location.

- Regular Account Monitoring: Review your account statements and transactions regularly for any suspicious activity. If you notice anything unusual, contact your bank immediately.

- Phishing Awareness: Be cautious of phishing emails or calls that attempt to trick you into revealing your personal information. Never click on suspicious links or give your banking details to unknown sources.

- Software Updates: Keep your computer and mobile devices up-to-date with the latest security patches and software updates.

Seeking Expert Advice

When it comes to finances, seeking expert advice is always a good idea. Financial advisors can provide guidance on investment strategies, managing debt, and making informed financial decisions. They can also help you understand the latest financial regulations and identify any potential risks. If you are unsure about something related to your bank account or financial security, don’t hesitate to contact your bank or a qualified financial professional.

Frequently Asked Questions

Q: What should I do if I suspect someone has accessed my bank account without my permission?

A: Contact your bank immediately and report the suspicious activity. They will investigate the issue and take steps to protect your account. You should also change your password and consider enabling multi-factor authentication for added security.

Q: How can I protect myself from phishing scams?

A: Be wary of emails or calls that ask for personal information, especially your bank account details. Never click on links in suspicious emails or call unknown numbers. If you receive a message claiming to be from a reputable source, verify the source by contacting the organization directly through their official website or phone number.

Q: Is it illegal to fake a bank balance even if I don’t use it for fraudulent purposes?

A: Yes, it is illegal. Attempting to deceive financial institutions or individuals with fake bank documents is a serious offense, even if you don’t intend to use it for financial gain. The consequences can be severe and could include fines, imprisonment, and damage to your reputation.

Checking Account Fake Td Bank Account Balance

https://youtube.com/watch?v=l24UeCZWmWc

Conclusion

The temptation to fake a bank account balance might seem alluring, but it’s vital to understand the severe risks associated with this practice. It’s illegal, unethical, and could lead to significant consequences. The best way to achieve financial success is through honest effort, responsible savings, and wise financial decisions. Prioritize honesty, transparency, and secure practices in your financial dealings.

If you are interested in learning more about financial security, fraud prevention, and responsible financial management, we encourage you to continue exploring. Seek expert advice, stay informed about the latest security threats, and make conscious choices to protect your financial well-being.